Chase Autosave

Help customers start and maintain a savings habit

I contributed to the redesign of the Autosave experience, simplifying the existing user flow and saving the business $3.6M in modernization costs.

My role

UX Designer, Design Strategy

Timeline

May 2023 - ongoing

Team

1 UX Designer, 1 Content Writer, 1 Researcher, 3 PMs

Platform

Native app (iOS, Android), web

Context

What is Autosave?

Launched in January 2019, Autosave helps Chase customers develop a savings habit by automating transfers from their internal Chase checking to internal Chase savings accounts.

In version 1, Autosave customers can setup goals and track against their progress and there are three rules live today: recurring, deposit-based, and daily.

Goals usage stats (Dec 2021)

11%

Safety net

11%

Custom goal

78%

General savings

Autosave rules stats (Dec 2021)

50%

On a schedule

45%

Deposit based

5%

On a daily basis

Over the past few years, Autosave has experienced a variety of issues…

Autosave and Pay & transfer have overlapping functionalities, which is the ability to enable recurring account transfers. Not only it is costly for the business, it also confuses the customer.

Autosave currently requires $3.6M to modernize, then $1M annual upkeep.

As a result, in Q1-Q2 2023. We start to leverage the Transfers backend and decommission the Autosave backend that exists today.

Pay & Transfer

Autosave v1 (2022)

Unsolicited feedback through Qualtrics and user research revealed usability and functionality issues with the tool:

Usability

“Doesn’t transfer when I expect”, “It doesn’t auto-pause based on my balance”, “Doesn’t work (general)”, “I didn’t set this up”

Control

“I can’t cancel”, “I want to view autosave amount separately”, “I want to turn off autosave on completed goals”, “I want to edit amounts and dates”

Understanding

“Teach me how to transfer”, “Help me understand service fees (transfers and low balance)"

Additionally…

Customers misunderstood that Pay & Transfer = Autosave, and that they expected their existing automatic money movement from checking to savings through Pay & Transfer to appear in Autosave.

Project Goal

What are we hoping to accomplish?

Our goal is to optimize the experience. We are going to do this by removing goals with low engagement and just keeping the general savings flow where we see higher engagement. We intend to further optimize the product by leveraging the Pay & Transfer team's recurring rules back end services to address our infrastructure. We believe that by removing low performing goals creation and focus our effort to making the recommended updates to make the general savings flow function properly we can drive higher engagement, build trust in the experience, and increase satisfaction.

How will this help users?

Our users will be able to regain trust in our experience

Our user will be able to set up their transfers and it will function as expected

Our users will get more control over their rule creation and get improved management experience

Our users will get an experience that is easier to understand and clarity on the value of savings via transfers

Timeline

Phase I (Sep - Dec 2023)

Remove custom goals and safety net (outcome: simplify general experience); Use Pay & Transfer technology and API (outcome: stabilize backend, save money for the business: $3.6M modernization and $1M yearly upkeep)

Phase II (Jan 2024)

Communication strategy (outcome: inform users about the new Autosave rollout and help customers avoid fees and interruptions)

Phase III (Mar 2024)

New Autosave rollout (outcome: easier experience, simplify the creation flow)

Phase IV (2024 and beyond)

Understand how people save within the context of spend; Understand the different mental models of how people want to save

What have I done so far?

Phase I (Sep 2023)

Remove Custom Goals and Safety Net

How might we give customers capability to simply set up and manage Autosave rules through Pay & Transfers and build trust?

The ability to create new Safety Net, Custom Goals and Daily transfers will be removed to minimize customer conversion impact and reduce the number of bankers with incentives impacts.

What customers will lose:

Existing rules and goals that have been created

Daily savings rule

Ability to create custom goals

Progress against goals

Immediate outcomes:

Simplify general experience and stabilize backend

Save $3.6M modernization, $1M yearly upkeep

General savings as the only transfer rule

Phase II (Jan 2024)

Communication Strategy

How might we communicate the upcoming Autosave changes to existing customers to avoid fees and interruptions?

We are providing notifications through different channels (in-app notifications; statement message; marketing emails) to communicate the upcoming changes to Autosave to the customers that are impacted.

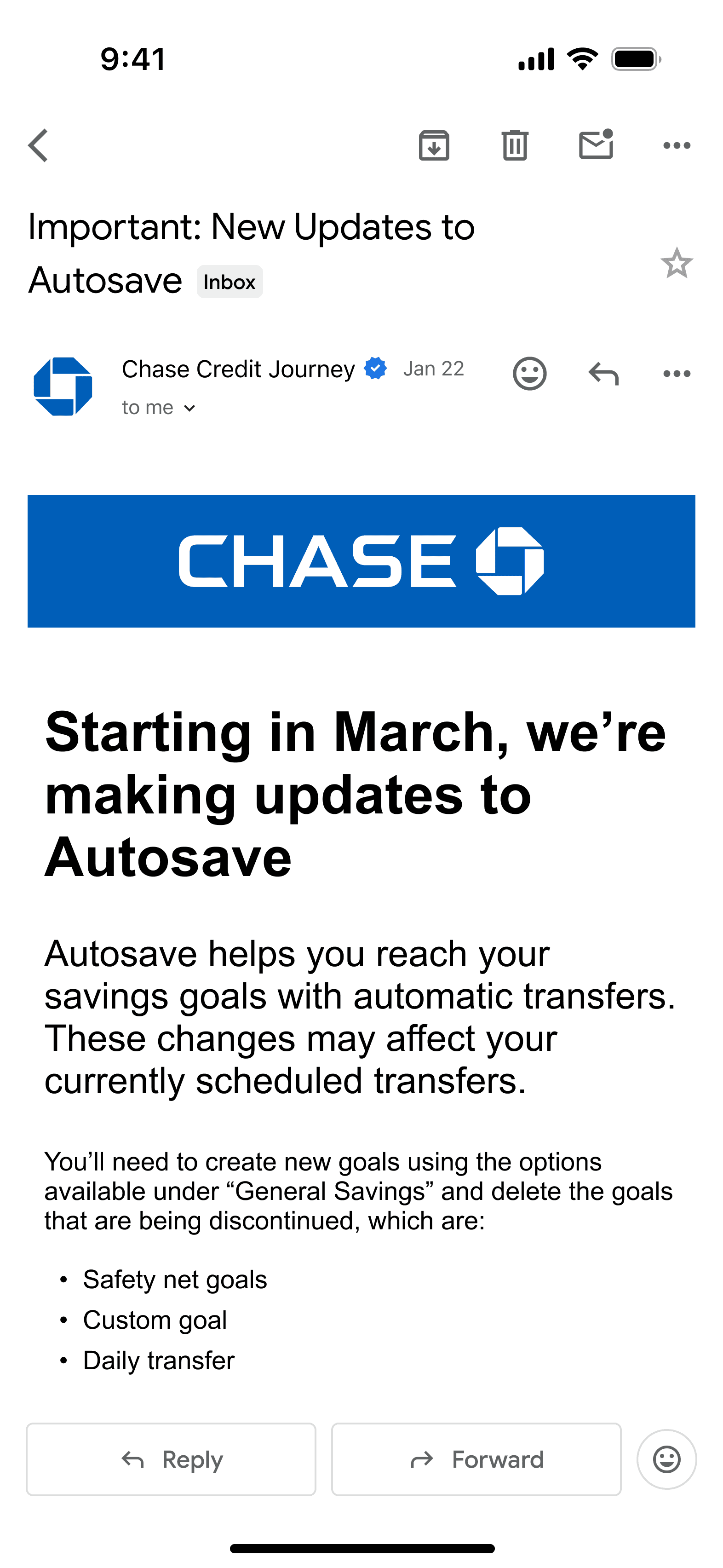

Marketing emails

In-app notifications

Phase III (Mar 2024)

New Autosave Rollout

How might we help our customers meet their savings objectives with clear, user-friendly tools, and convenient money movement using recurring and deposit-based transfers?

Autosave has been causing several usability issues for our customers in addition to being costly for JPMC to maintain. It has also been identified that the Pay & Transfers product has a very similar experience to automate money movement, and we believe it would be beneficial to the business and customers to leverage this technology. The plan is to utilize the payments services and create a modified Autosave UI experience to support recurring and deposit rules.

Key customer problems to solve:

As a customer I want an experience that is easy and automated and allows me to build a savings cushion over time.

As a customer who created a savings goal by using a recurring money movement to build up savings, I want to have an easy way to stop, pause or manage those money movements to allow it to flex with my current finances.