Launched

Chase Budget

Help customers build a better spending habit

I was tasked to redesign the Budget tool due to low satisfaction and usage scores. Customers were dissatisfied with the tool because it lacks features that effectively help them reduce their spending.

2023 Fintech Breakthrough Award

- Best Finance Product

My role

UX Designer, Design Strategist

Timeline

Dec 2021 - ongoing

Team

2 UX Designers

2 Content Writers

3 PMs

1 UX Researcher

Platforms

Native app (iOS, Android) , website

Data suggested the budget tool wasn’t meeting our customers’ needs

Chase Budget empowers users to take control of their finances, make informed choices, and prepare for future expenses by offering a clear view of spending habits, enabling them to set monthly budgets, track expenses, and monitor spending patterns.

However, with 17M eligible population, only 12% are clicking into the experience. Among them, less than 600K users have enrolled in budget. Additionally, only 18K are active monthly users, which is about 3% of the total users. The Budget tool also has a high customer drop off as users find the experience complex and want more control when managing their spending.

budget creation flow (2021)

Budget dashboard (2021)

Our customer feedback analysis highlighted UX problems related to usefulness, control, and inconsistency across multiple tools.

Data inconsistency

“My ‘spent so far’ number on the budgeting page does not match the number in ‘spending summary’ page. Why is that?”

Data inaccuracy

“I have account transfers, but the tool is pulling them in as monthly bills. They do not appear in the account transfer section at all, even after removing from the bill section.”

Savings goal

"Instead of concluding budget as a subtraction between income to checking and expenditures and setting your budget to equal 0 savings, users should have the ability to set budget below the difference between their monthly income and fixed costs”

Budget categories

“Please include set budgets for different categories like Mint does. I want to budget my restaurant, gas, and shopping money.”

No editing capabilities

“It needs an editing tool to change the budget if needed instead of having to reset the whole budget every time.”

One seamless, better, and more intuitive experience

The goal of the project is to revamping the existing budget tool by providing features like budget by category, simplifying the creation flow, and account for saving intentions. Additionally, we aim to better integrate the budget tool with Spending Summary to better help users to spend and save more wisely.

Business objectives

Customer acquisition

Provide features that empower customers and solve users’ needs; Design visually appealing experiences; Create easy, intuitive, all-in-one experience.

Customer retention

Monitor closely user satisfaction, create personalized recommendations and insights to keep customers engaged and encourage repeat usage.

Product adoption

Create in-app tutorials; ensure the feature integrate smoothly with the rest of the product by adding entry points from different experiences; Highlight other relevant tools and experiences within the product.

Identify the target users and learn from them

I assisted in the user research session and conducted 12 qualitative user interviews to gain a better understanding of our customers’ spending behavior, and learned how users interact with the experience. Some key insights we collected are as follows:

Behavior:

Want to monitor finances to be simple, interesting, and fun, not a chore

Lack confidence and want guidance while monitoring finances

Want help to stay on top of it

Financial type:

Log onto the Chase app frequently to check balances and transactions.

Looking for ways to improve financial habits

Tend to spend more than they save

Learn from our competitors

Next, to better understand how other digital tools work, I conducted a competitive audit of a few competitors’ app. This helped us analyze strengths and pain points for each of the digital experiences, and identify opportunities and areas for improvements.

Rocket Money (truebill)

Mint (decommissioned)

Vision — Designing for users mental models

After rounds of research and discovery sessions, the team had a better awareness of the existing problems and what customers are looking for. Partnering with PMs, I helped developing a vision for the new Budget experience:

Give me a plan

Step-by-step tools and customized suggestions for being more purposeful about financial decisions

Help me stick to my plan

Trusted advice and encouragement, which touch points in and outside of Chase Digital

Help me make trade-off decisions

Strategize, pivot, and act with a clear understanding of the implications

Do it for me or make it easy for me

Set my plan on autopilot or give me clear paths to take actions

How might we simplify the set up flow to increase completion score?

One identified problem our budget customers are facing is that the creation flow is lengthy and complex, currently, customers have to go through 5 mandatory steps to create their monthly budget. The monthly bills and monthly transfers steps require customers to analyze their transactions in order to proceed to the final step.

To simplify the experience, the team and I analyzed the users behavior and identified ways to reduce the time spent on the creation flow:

Step 1: Accounts selection

Users typically select all of their accounts, including Chase and external accounts. This step could be removed since only a few percentage of users would deselect some of their accounts.

Step 2: Monthly income

For customers that do not have a direct deposit account with Chase, the monthly income will show an amount of $0 by default, customers have to manually input their monthly income to proceed. In addition, customers have expressed the demand to save a portion of their income for unexpected purchases. There’s an opportunity to allow users to easily edit their income information, as well as allocating a portion of the income.

Step 3: Monthly bills

We’ve learned that the current system cannot detect recurring bills from external accounts, customers have to manually calculate all their monthly bills and requires a lot of time and effort. We can potentially allow customers to easily edit their monthly bills information and perhaps make this step skippable to increase completion rate.

Step 4: Monthly transfers

The majority of our customers do not have recurring transfers through Chase, which make this step unnecessary. The opportunity here could be removing this step, while for Chase customers, we can potentially categorize the monthly transfers as one of the pre-set categories.

Step 5: Review

This step is essential as it allows customers to have an overview of their monthly budget, and allows them to make final adjustments before completing the creation flow.

Cut back and identify spending pattern on specific categories

Other than creating a monthly overall budget, customers are also demanding the option to create distinct budgets for each of the categories. Customer can better monitor their granular spending more closely and save money on frequently spent categories such as shopping, dining, or groceries. This feature is available in all our competitors app, and brings a huge user value and satisfaction.

old budget creation flow

new budget creation flow

How might we improve the budget dashboard and better integrating it with Spending Summary?

The previous Budget experience was not well integrated with Spending Summary, users often times find the numbers not matching and did not talk to each other. In addition, it misses some key functionalities that makes the tool useful. There were no way to easily adjust the numbers and users have to reset the entire experience to do that.

Solution — A more simplified dashboard

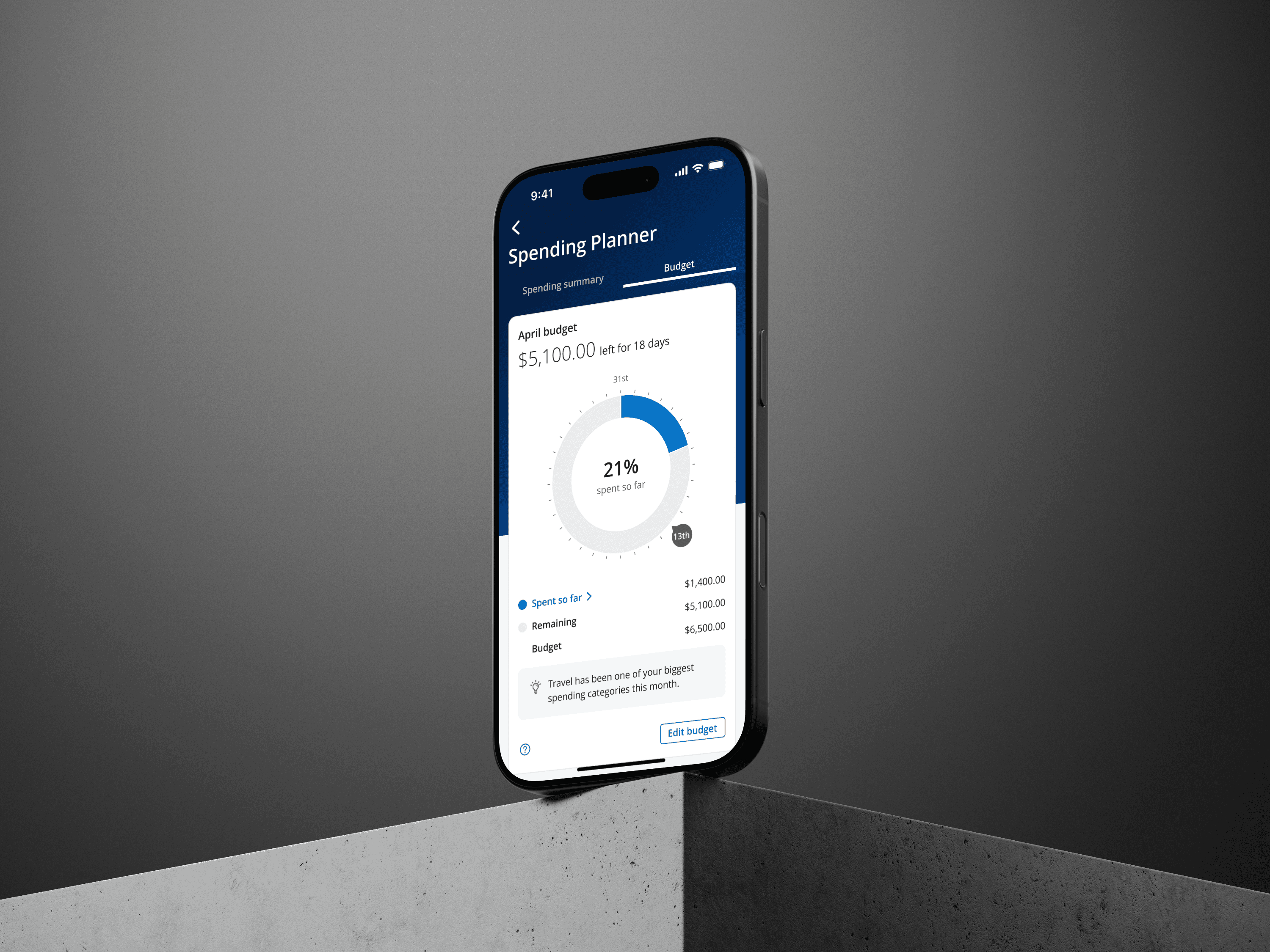

The new budget dashboard consist of a simplified metronome that displays users spending vs amount left to spend, a new entry point that allow users to quickly manage and edit the budget number, a new tile that allow users to add, edit ,or remove category budgets, and a new feature called ‘end of month summary’ that shows users’ previous month performance (last month spending, top spending category, and actual savings amount).

We also introduced a new experience called Spending Planner that seamlessly integrate Budget with Spending Summary, providing a combined, holistic experience that better helps users to track and manage their money.

old budget dashboard

new budget dashboard

new budget compared to previous version

Satisfaction

49%

78% increase

cumulative users

1.3M

5x increase

completion

36%

33% increase

Challenges and Insights from the Redesigned Budget Tool Launch

Since launching the redesigned Budget tool, we’ve seen an increase in satisfaction and engagement scores, though we're still below the 2024 benchmark. The drop-off rate is higher than expected, largely because users must go through the setup flow. Additionally, usage numbers are falling short due to low discoverability. Our existing customers are also requesting a more streamlined budgeting experience that integrates better with Spending Summary to help manage their finances more effectively.

Budget creation flow drop off rate

Existing problems:

66% of users that start the budget set up flow do not complete it

Users cannot set budgets for all the categories listed in Spending Summary

Users need more granular/custom categories

No easy access to Budget (requires multiple clicks)

No reminders/alerts about budget progress

How might we help our customers reduce friction and further integrate Budget with Spending Summary?

We're now combining Budget with Spending Summary to create a more seamless experience. Customers can skip the lengthy enrollment process to set up budgets, and we're aligning categories across both tools, allowing customers to create budgets for any category they choose.

detached budget and spending summary

integrating budget with spending planner